Your credit score in 2025 is more than just a number—it’s a key to unlocking financial opportunities, from securing low-interest loans to renting your dream apartment. Understanding how your credit score works, what impacts it, and how to improve it is essential for financial success. This comprehensive guide breaks down everything you need to know about your credit score, with actionable tips to boost it and real-world examples to make it relatable.

What Is a Credit Score?

A credit score is a three-digit number that reflects your creditworthiness, typically ranging from 300 to 850. It’s calculated based on your financial behavior, like how you manage loans, credit cards, and bills. In 2025, credit scores remain a critical factor for lenders, landlords, and even employers to assess your financial reliability.

For example, Sarah, a 28-year-old graphic designer, was denied a car loan because her credit score was 620. After learning how her score worked, she took steps to improve it and boosted it to 720 within a year, securing a better loan rate.

Why Your Credit Score Matters

Your credit score in 2025 can impact multiple aspects of your life. Here’s why it’s so important:

- Loan Approvals and Interest Rates: A higher credit score means better loan terms and lower interest rates. According to Experian, borrowers with scores above 760 can save thousands on interest compared to those with scores below 620.

- Renting or Buying a Home: Landlords and mortgage lenders check credit scores to gauge reliability.

- Job Opportunities: Some employers review credit reports, especially for finance-related roles.

- Insurance Premiums: Insurers may use credit-based scores to determine rates.

Takeaway: Monitor your credit score regularly to ensure it reflects your financial health accurately.

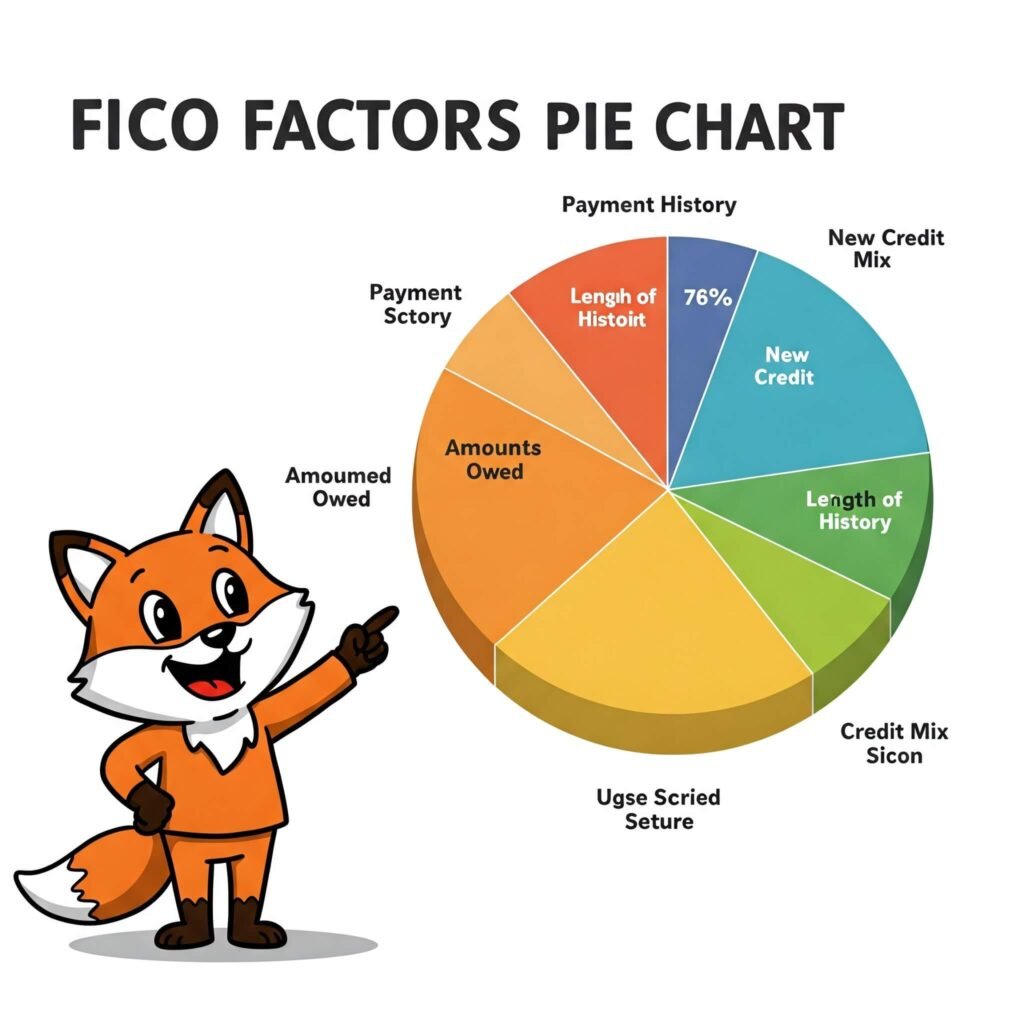

How Is Your Credit Score Calculated?

Your credit score in 2025 is determined by five key factors, as outlined by the FICO scoring model, which is widely used:

- Payment History (35%): Paying bills on time is the most significant factor. Late payments can drop your score significantly.

- Credit Utilization (30%): This is the ratio of your credit card balances to your credit limits. Aim to keep it below 30%.

- Length of Credit History (15%): Longer credit accounts improve your score.

- New Credit (10%): Opening multiple new accounts in a short time can lower your score.

- Credit Mix (10%): A mix of credit cards, loans, and mortgages can positively impact your score.

Debunking Common Credit Score Myths

Misinformation about credit scores can lead to costly mistakes. Let’s debunk some myths:

- Myth: Checking your credit score hurts it.

Truth: Soft inquiries, like checking your own score, don’t affect it. Hard inquiries (e.g., loan applications) may have a small impact. - Myth: Closing old accounts boosts your score.

Truth: Closing accounts can shorten your credit history and increase utilization, lowering your score. - Myth: You only have one credit score.

Truth: You have multiple scores from agencies like FICO and VantageScore, though ranges are similar.

Outbound Link: Learn more about credit score myths at Equifax.

Tips to Boost Your Credit Score

Boosting your credit score in 2025 doesn’t have to be overwhelming. Follow these actionable tips:

- Pay Bills on Time: Set up automatic payments to avoid late fees.

- Lower Credit Utilization: Pay down credit card balances or request a credit limit increase.

- Review Your Credit Report: Check for errors on your report from AnnualCreditReport.com. Dispute inaccuracies promptly.

- Avoid New Hard Inquiries: Limit applications for new credit unless necessary.

- Keep Old Accounts Open: Maintain older accounts to preserve your credit history.

Real-World Example: John, a 35-year-old teacher, improved his credit score from 650 to 740 in six months by paying off $2,000 in credit card debt and correcting an error on his credit report.

Tools to Track Your Credit

Several free tools can help you monitor your credit score:

- Credit Karma: Offers free VantageScore updates and credit monitoring.

- Experian Boost: Allows you to add utility and phone payments to your credit file.

- Bank Apps: Many banks, like Chase and Capital One, provide free credit score tracking.

Outbound Link: Explore free credit monitoring tools at Credit Karma.

What’s New for Credit Scores in 2025?

In 2025, credit scoring models are evolving to reflect modern financial behaviors:

- Alternative Data: Some models now consider rent, utility, and streaming service payments.

- AI-Powered Scoring: Lenders are using AI to analyze spending patterns for more accurate assessments.

- Increased Focus on Financial Health: New tools emphasize budgeting and debt management alongside credit scores.

Data Insight: A 2024 TransUnion study found that 65% of Gen Z consumers improved their credit scores by using alternative data reporting.

Final Thoughts on Your Credit Score

Your credit score in 2025 is a powerful tool for achieving your financial goals. By understanding how it’s calculated, debunking myths, and taking proactive steps, you can improve your score and unlock better opportunities. Start small—check your credit report, pay bills on time, and use free monitoring tools. With consistent effort, you’ll see results.

Call to Action: Check your credit score today and take one step to improve it. Share your progress in the comments below!