Financial freedom is a dream for many, but it starts with mastering budgeting tips for financial freedom. A solid budget isn’t just about cutting expenses—it’s about creating a roadmap to achieve your financial goals. Whether you’re paying off debt, saving for a house, or planning for retirement, these practical budgeting tips will empower you to take control of your finances. This article breaks down actionable strategies, real-world examples, and expert insights to help you pave the way to financial independence.

Why Budgeting Is the Key to Financial Freedom

Budgeting tips for financial freedom are essential because they provide structure to your financial life. A budget helps you prioritize spending, eliminate wasteful habits, and focus on long-term goals. According to a 2023 survey by the National Foundation for Credit Counseling, 60% of Americans don’t have a budget, and 65% feel stressed about money. Creating a budget reduces financial anxiety and sets you on the path to independence.

Top Budgeting Tips for Financial Freedom

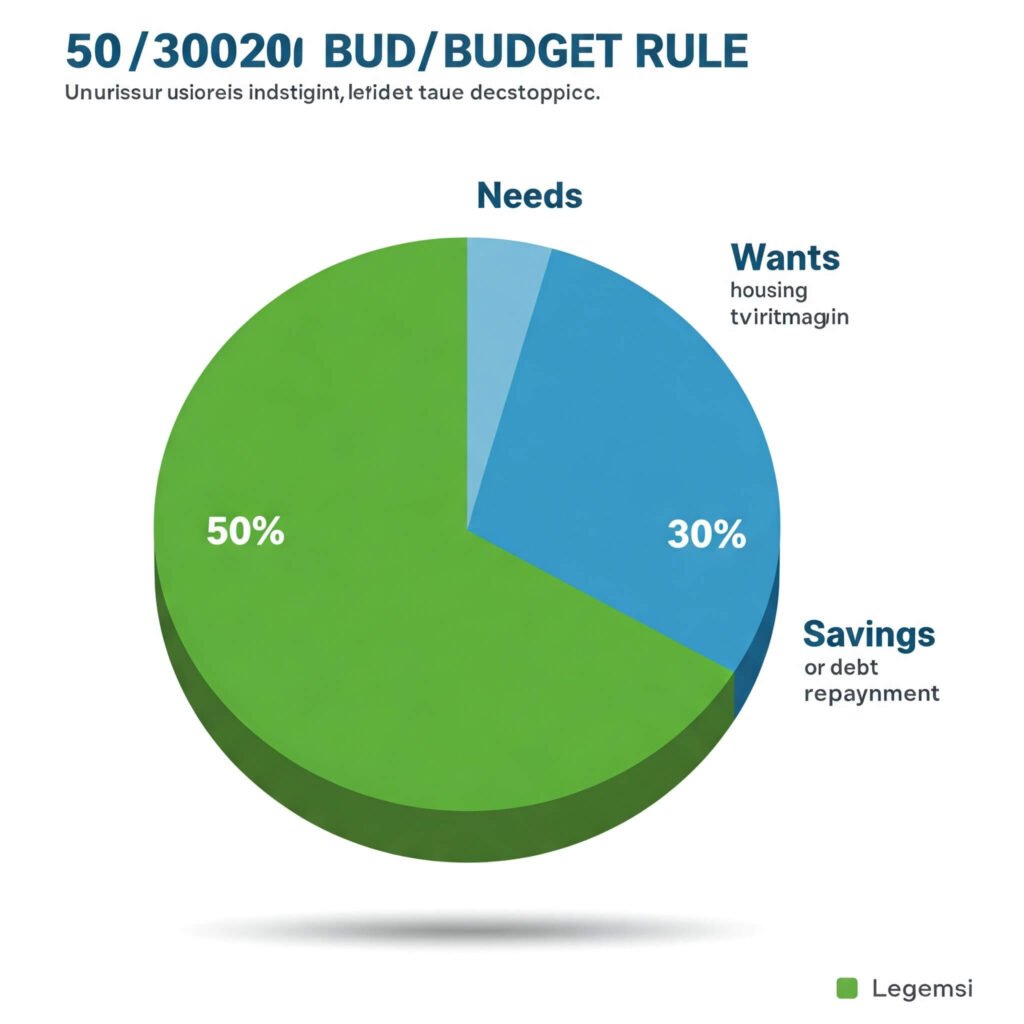

1. Follow the 50/30/20 Rule

One of the most effective budgeting tips for financial freedom is the 50/30/20 rule, popularized by Senator Elizabeth Warren. Allocate your income as follows:

- 50% Needs: Essentials like rent, utilities, and groceries.

- 30% Wants: Non-essentials like dining out or subscriptions.

- 20% Savings/Debt: Savings, investments, or debt repayment.

Example: Sarah, a 30-year-old teacher, earns $4,000 monthly. She spends $2,000 on rent and bills, $1,200 on hobbies and dining, and saves $800. This simple framework helped her save $9,600 in a year.

2. Track Your Spending Religiously

You can’t manage what you don’t measure. Use apps like YNAB (You Need a Budget) or Mint to track every dollar. Review your spending weekly to identify patterns and cut unnecessary expenses.

Tip: Set aside 10 minutes each Sunday to categorize your expenses. Small leaks, like daily coffee runs, can add up to hundreds of dollars annually.

3. Build an Emergency Fund

Financial freedom requires a safety net. Aim to save 3-6 months’ worth of living expenses in an emergency fund. Start small—$500 can cover minor emergencies like car repairs.

Example: When John’s laptop broke, his $1,000 emergency fund saved him from dipping into credit cards, keeping his budget intact.

Advanced Budgeting Strategies for Financial擅长

4. Automate Your Savings

Automating savings is a game-changer among budgeting tips for financial freedom. Set up automatic transfers to a high-yield savings account or investment portfolio. This removes the temptation to spend before saving.

Pro Tip: Use accounts like Ally Bank for high-interest savings (up to 4% APY in 2025).

5. Pay Off High-Interest Debt

Debt is a roadblock to financial freedom. Focus on paying off high-interest debts (like credit cards) using the avalanche method: prioritize debts with the highest interest rates first.

Example: Lisa had $10,000 in credit card debt at 18% interest. By paying $500 monthly on the highest-interest card, she saved $2,000 in interest over two years.

Common Budgeting Mistakes to Avoid

1. Ignoring Small Expenses

Small purchases add up. A $5 daily coffee habit costs $1,825 annually. Use budgeting tips for financial freedom to cut these micro-expenses.

2. Not Adjusting Your Budget

Life changes, and so should your budget. Revisit your budget every 3-6 months to account for income changes, new goals, or unexpected expenses.

3. Neglecting Fun

A budget that’s too strict can lead to burnout. Allocate a small “fun fund” to enjoy guilt-free treats, like a movie night or a weekend getaway.

Tools to Support Your Budgeting Journey

- YNAB: Best for detailed budgeting.

- Mint: Free and user-friendly for beginners.

- Personal Capital: Great for tracking investments and net worth.

These tools make budgeting tips for financial freedom easier to implement, saving you time and stress.

Conclusion: Start Your Journey to Financial Freedom Today

Budgeting tips for financial freedom are your roadmap to a stress-free financial future. By following the 50/30/20 rule, tracking spending, building an emergency fund, and avoiding common mistakes, you can achieve your financial goals. Start small, stay consistent, and watch your savings grow. Financial freedom isn’t a destination—it’s a journey, and every step counts.

What’s your favorite budgeting tip? Share in the comments below, and let’s build a community of financially savvy readers!

Outbound Links for Credibility: