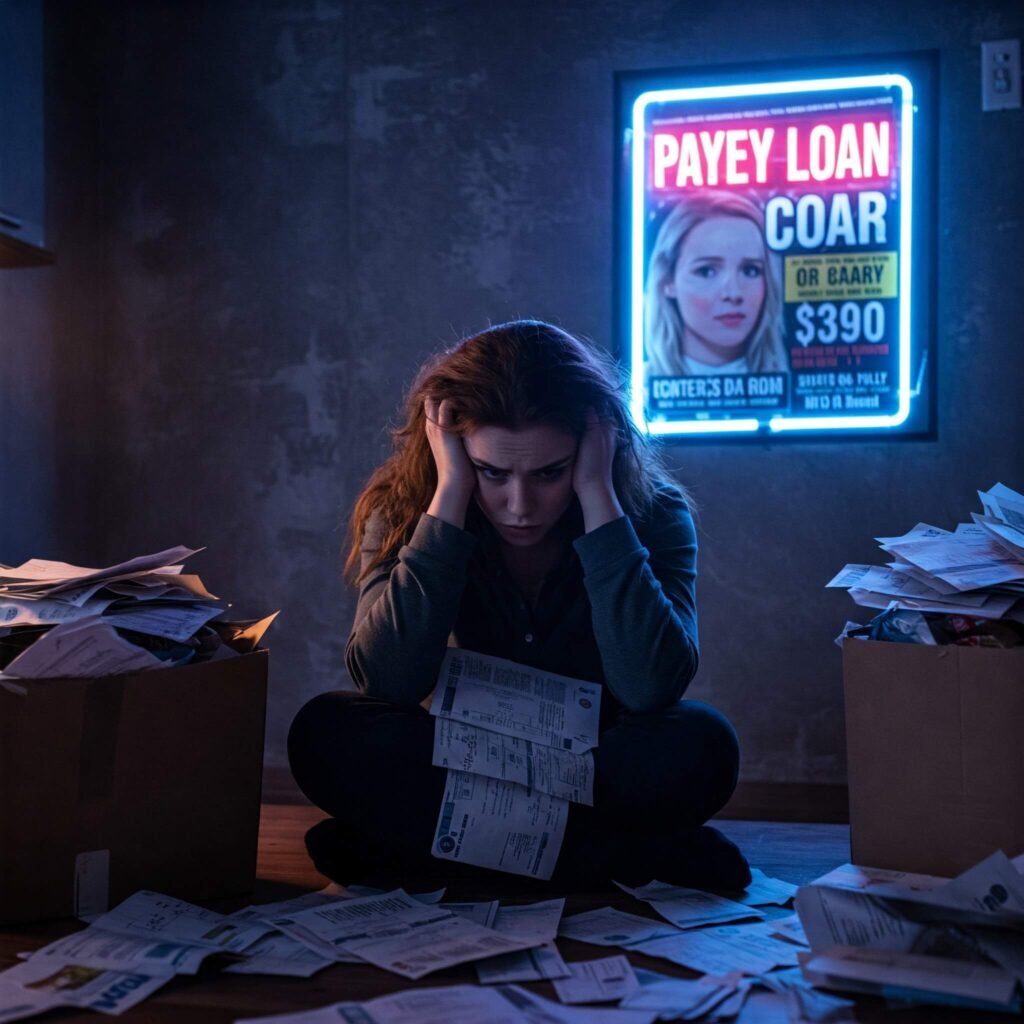

Payday loans can seem like a quick fix when you’re strapped for cash, but they come with significant risks and costs that can trap borrowers in a cycle of debt. Before you consider taking out a payday loan, it’s critical to understand how they work, their potential pitfalls, and smarter alternatives to meet your financial needs. This guide breaks down everything you need to know to make an informed decision.

Why Payday Loans Seem Appealing

Payday loans are short-term, high-interest loans typically due on your next payday. They’re marketed as a fast solution for emergencies, like covering a car repair or unexpected medical bill. Their appeal lies in:

- Speed: Funds are often available within hours or the next business day.

- Accessibility: Lenders rarely check credit scores, making them an option for those with poor credit.

- Simplicity: Minimal paperwork and straightforward requirements, like proof of income and a bank account.

However, the convenience of payday loans comes at a steep price. Let’s explore why.

The Hidden Costs of Payday Loans

Payday loans may seem affordable at first glance, but their costs can quickly spiral. According to the Consumer Financial Protection Bureau (CFPB), the average payday loan carries an annual percentage rate (APR) of around 400%, compared to 15-30% for most credit cards. Here’s what drives these costs:

- High Fees: Lenders charge $10-$30 per $100 borrowed, meaning a $300 loan could cost $45-$90 in fees for just two weeks.

- Short Repayment Terms: Loans are typically due in 14 days, leaving little time to repay without borrowing again.

- Rollover Traps: If you can’t repay on time, lenders may offer to “roll over” the loan for another fee, increasing your debt.

For example, Sarah, a single mom, took out a $500 payday loan to cover rent. Unable to repay in two weeks, she rolled it over twice, paying $150 in fees while still owing the original $500. This cycle is common, with CFPB data showing 80% of payday loans are rolled over or renewed within 14 days.

Risks of Borrowing Payday Loans

The convenience of payday loans masks serious risks that can harm your financial health. Understanding these dangers is crucial before borrowing:

- Debt Spiral: High fees and short terms make it hard to repay, leading to repeated borrowing.

- Bank Account Drains: Lenders often require access to your bank account, and missed payments can trigger overdraft fees.

- Credit Damage: While payday lenders don’t report to credit bureaus, unpaid loans sent to collections can hurt your credit score.

- Predatory Practices: Some lenders use aggressive MBS (Main Business System) tactics to pressure borrowers into unfavorable terms.

Alternatives to Payday Loans

Before turning to payday loans, explore safer options to address your financial needs. These alternatives can help you avoid the high costs and risks:

- Personal Loans: Banks or credit unions offer loans with lower interest rates and longer repayment terms.

- Credit Card Cash Advances: While not ideal, cash advances often have lower APRs than payday loans.

- Payment Plans: Negotiate with creditors (e.g., medical providers or utility companies) to set up affordable payment plans.

- Emergency Savings: Build a small emergency fund, even $500, to cover unexpected expenses.

- Local Assistance Programs: Nonprofits, community organizations, or government programs may offer grants or low-cost loans.

For instance, John, a retail worker, faced a $600 car repair bill. Instead of a payday loan, he negotiated a payment plan with the mechanic and borrowed $200 from a family member, avoiding costly fees.

How to Protect Yourself When Considering Payday Loan

If you must consider a payday loan, take these steps to minimize risks and make an informed choice:

- Shop Around: Compare fees, terms, and APRs from multiple lenders.

- Read the Fine Print: Understand all terms, including repayment deadlines and penalties.

- Borrow Only What You Need: Avoid taking more than you can repay by your next paycheck.

- Have a Repayment Plan: Budget for the loan repayment to avoid rollovers.

- Check Lender Credentials: Ensure the lender is licensed and reputable, using resources like the Better Business Bureau.

Key Takeaways for Smart Borrowing

Payday loans can be a tempting quick fix, but their high costs and risks often outweigh the benefits. By understanding how they work, exploring alternatives, and planning carefully, you can protect your financial future. Here’s what to remember:

- Payday loans carry APRs as high as 400%, making them one of the costliest borrowing options.

- Safer alternatives like personal loans or payment plans can save you money.

- Always read the terms and have a repayment plan before borrowing.

For more information on managing finances or avoiding predatory lending, visit trusted resources like the Federal Trade Commission (FTC) or National Foundation for Credit Counseling (NFCC).

outbound links:

- Consumer Financial Protection Bureau (CFPB) – Payday Loans – Official U.S. government resource on payday loan risks and regulations.

- Federal Trade Commission (FTC) – Payday Loans – FTC’s guide on avoiding payday loan scams.

- Consumer.gov – Payday Loans – Simple breakdown of payday loan by the U.S. government.

- National Foundation for Credit Counseling (NFCC) – Offers free or low-cost debt counseling.

- Debt.org – Payday Loan Alternatives – Expert advice on managing payday loan debt.

- Legal Services Corporation (LSC) – Free legal help for low-income borrowers.

- American Fair Credit Council (AFCC) – Reputable debt settlement resources.