Why Life Insurance Matters for Your Family’s Future

Life insurance is a cornerstone of financial planning, ensuring your family’s future remains secure even in your absence. It provides a financial safety net, covering expenses like mortgages, education, and daily living costs. According to the Life Insurance Marketing and Research Association (LIMRA), 44% of U.S. households lack life insurance, leaving families vulnerable to financial hardship.

Real-World Example: Sarah’s Story

Sarah, a single mother of two, purchased a term life insurance policy. When she unexpectedly passed away, the policy paid off her mortgage and funded her children’s college education. Without life insurance, her family might have faced foreclosure and debt. This highlights how life insurance for your family’s future can be a lifeline.

Key Benefits of Life Insurance for Family Protection

Life insurance offers unmatched benefits for securing your family’s future. Here’s why it’s a must:

- Debt and Mortgage Protection: Covers outstanding loans, ensuring your family isn’t burdened by debt.

- Income Replacement: Replaces lost income, maintaining your family’s lifestyle.

- Education Funding: Secures funds for your children’s education, from school to college.

- Peace of Mind: Eliminates financial stress, letting your family focus on healing.

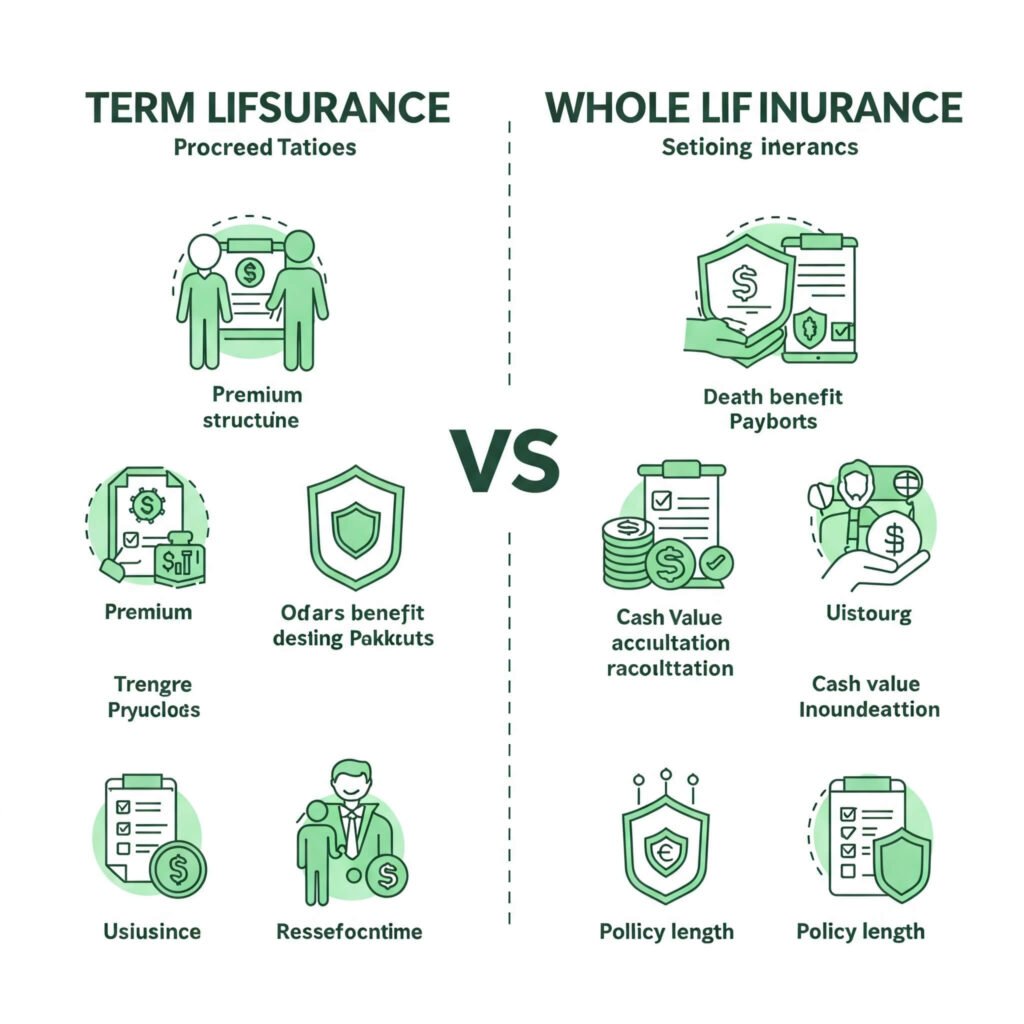

Term vs. Whole Life Insurance: What’s Best for Your Family’s Future?

- Term Life Insurance: Affordable, covers a specific period (e.g., 20 years). Ideal for young families.

- Whole Life Insurance: Lifelong coverage with a savings component. Suits long-term financial planning.

For tailored advice, explore Policygenius to compare life insurance quotes.

How Life Insurance Enhances Family Financial Security

Life insurance for your family’s future isn’t just about covering expenses—it’s about building a legacy. It ensures your family can thrive, not just survive. For instance, a $500,000 policy could cover a 30-year mortgage, childcare, and emergency savings, based on average U.S. household expenses (Bureau of Labor Statistics).

Actionable Steps to Choose the Right Policy

- Assess Your Needs: Calculate debts, income, and future expenses (e.g., college costs).

- Compare Quotes: Use platforms like NerdWallet for competitive rates.

- Consult an Expert: Work with a financial advisor to customize your policy.

- Review Annually: Adjust coverage as your family’s needs evolve.

Common Myths About Life Insurance for Your Family’s Future

Misconceptions can deter families from securing life insurance. Let’s debunk a few:

- Myth 1: It’s Too Expensive

Reality: Term life insurance can cost as little as $20/month for healthy individuals (Forbes). - Myth 2: Only Breadwinners Need It

Reality: Stay-at-home parents need coverage for childcare and household costs. - Myth 3: I’m Too Young

Reality: Younger applicants get lower rates, locking in savings.

Take Action: Secure Your Family’s Future Today

Life insurance for your family future is a proactive step toward financial security. Don’t wait for the unexpected—start exploring options now. Visit Insure.com for free quotes or consult a licensed agent to find a policy that fits your budget and goals.

By investing in life insurance, you’re not just buying a policy—you’re building a foundation for your family’s dreams.